Judge stays Oregon couple’s discrimination lawsuit against USDA

Published 9:45 am Tuesday, September 28, 2021

- U.S. Magistrate Judge Patricia Sullivan has put litigation on hold to “avoid unnecessary, duplicative government action” because the plaintiffs, Kathryn and James Dunlap of Baker City, are already represented in a class action lawsuit against the $4 billion USDA loan forgiveness program.

PORTLAND — A federal judge has stayed a lawsuit Oregon couple brought who challenged a USDA loan forgiveness program for allegedly discriminating against white farmers.

U.S. Magistrate Judge Patricia Sullivan has put the litigation on hold to “avoid unnecessary, duplicative government action” because the plaintiffs, Kathryn and James Dunlap, are already represented in a class action lawsuit against the $4 billion debt relief program.

The judge said the “interests of judicial efficiency weigh in favor of a stay” because it would “not unduly prejudice plaintiffs, nor would it present tactical disadvantages to plaintiffs.”

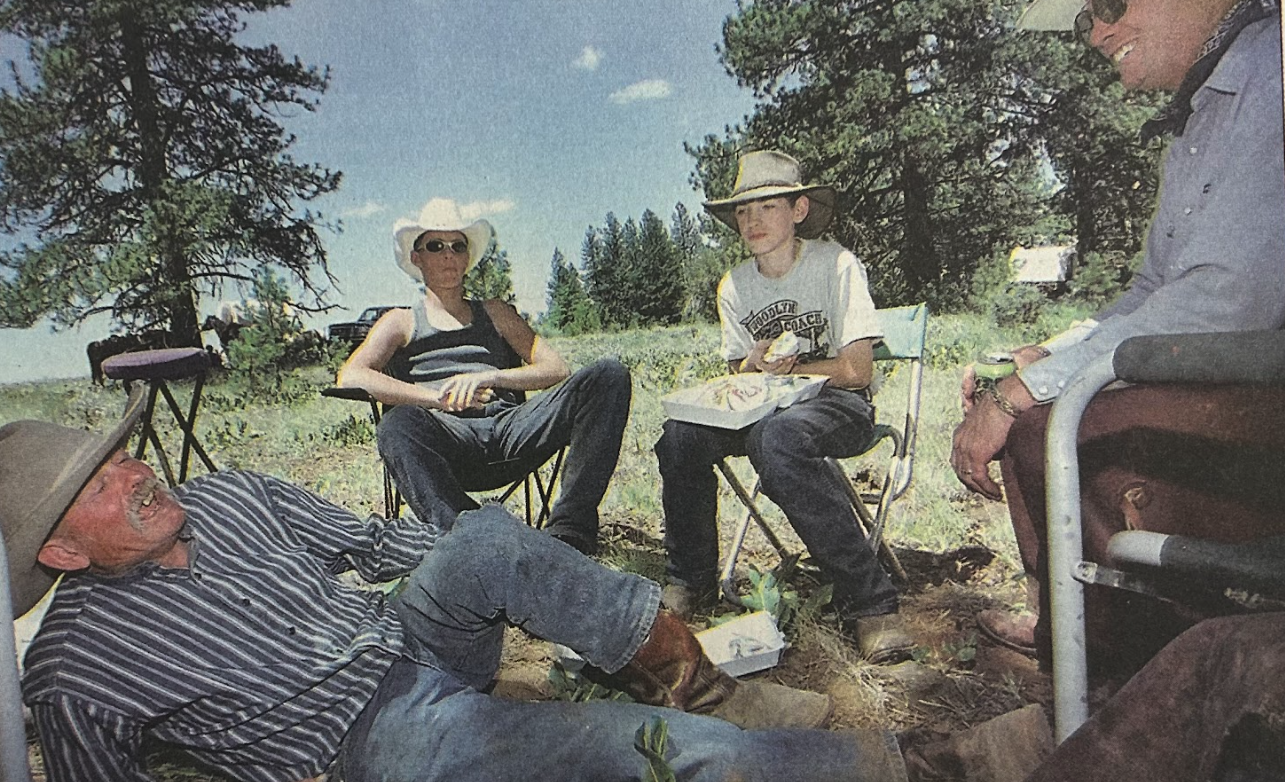

The Dunlaps, who farm near Baker City, are among several growers across the U.S. who have claimed white farmers were unlawfully excluded from the loan assistance program, which Congress passed as part of COVID-19 relief legislation earlier this year.

Under the program, farmers who are Black, Native American, Asian, Hawaiian or Pacific Islander are eligible for payments of up to 120% of their USDA loans, which critics argue violates equal protection under the law.

“Farmers and ranchers who are white are ineligible for loan assistance, regardless of their individual circumstances,” according to the complaint filed by the Dunlaps, who have otherwise qualifying USDA loans for cattle and farm equipment.

The USDA argued their lawsuit and similar ones must be stayed because a class action case has been certified in Texas that already represents their interests while also enjoining the debt relief program.

The Dunlaps objected to the stay, arguing the class action may not adequately represent their interests, but the judge said she would follow the example of federal courts in several other states that have put similar cases on hold. The Texas class action lawsuit “involves the same defendants, general claims, and request for relief as in the present case,” she said.

However, the judge said the Dunlaps can ask to lift the stay if they opt out of the class action lawsuit, which they and other farmers are trying to do. The couple are among a group of 12 farmers who’ve filed a motion to opt out of the Texas case because they “should be allowed to pursue their chosen claims, with their chosen counsel, in their chosen forums.”

These farmers argue the class action complaint more broadly attacks USDA programs for alleged racial discrimination while they are specifically targeting the loan forgiveness program. The class action lawsuit also includes different legal theories, they claim.

“At a minimum, it reveals key differences in litigation strategy that support allowing Movants to opt out,” the motion said.

These farmers argue the debt relief program violates the Administrative Procedure Act while the Texas lawsuit does not, and they worry the class action will be subject to delays for reasons their own complaints would not be.

Allowing them to opt out will also not harm the overall class action litigation, the farmers claim. “Indeed, the removal of a mere handful of the more than 20,000 farmers who are members of the certified classes would not negatively impact the remaining class members in any way.”

The USDA opposes their motion, arguing the Texas lawsuit is the type of class action litigation that seeks broad injunctive relief on constitutional grounds from which individual members cannot opt out.

Because the remedy sought by the farmers is of an “indivisible nature,” allowing them to “pursue their individual claims would be fruitless and counter-productive,” the USDA said.