FAB Life returns to teach students how expensive it is to be an adult

Published 7:00 am Saturday, May 22, 2021

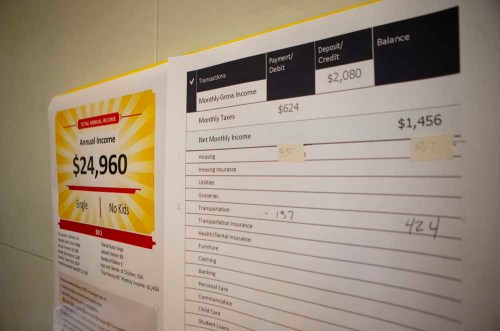

- A sample simulation sheet hangs on the wall of the gymnasium at Hermiston High School during the FAB Life simulation on Wednesday, May 19, 2021.

HERMISTON — Joshua Farias needed a roommate.

The single father of two, making $36,480 per year as a restaurant manager, was almost out of money for the month but still needed to pay for utilities, a car and clothing for himself and his children. So he asked around until he found someone willing to pay half the mortgage for a room in his three-bedroom home.

Trending

Fortunately for Farias, he isn’t actually a father of two, just a Hermiston High School senior participating in a budgeting simulation meant to teach students about the cost of living. And he learned, to his surprise, just how expensive adult life can be.

“Housing is the most expensive,” he said.

The budgeting exercise, known as FAB Life, took place on May 19-20 at the high school. Seniors were each given a scenario sheet detailing aspects of their “life,” including their profession, annual salary, monthly take-home pay, married status and number of children. They had to then visit booths around the gym, staffed by volunteers who explained their spending options to them.

At the child care booth, students were given options ranging from public child care centers to a nanny, with price tags based on the number and age of their children. Kory Terry and Miranda Cranston, who were running the booth, said students were often surprised at the cost.

“They’re giving us ‘wow’ eyes, like, ‘Are you serious?’” Terry said.

Important choices

Trending

Cranston said a few students said it was important to them that their child got the best care possible and hired a nanny, but most students chose the cheapest option.

A few booths down, Candelario Rodriguez was giving students a price for their car insurance, based on the vehicle they had chosen at the transportation booth. He said he was surprised how many students had chosen to drive a used car, even if they were single and making a high salary.

When a girl visited his booth and shared the type of car she had purchased, he talk to her about the importance of purchasing car insurance before letting her know it would be $85 a month.

While most of the booths caused students to add a new expense to their budget, those who were running out of money could visit the supplemental income booth to find out ways they could increase their revenue.

Lori Spencer went over options with students that ranged from picking up a second job in the evenings to holding a yard sale for a one-time infusion of cash. Some students who visited the booth learned that as a single parent they were entitled to child support. One student decided he was going to have his teenage daughter babysit to help cover rent.

“I’m surprised at seeing some of them with higher income already coming to me,” Spencer said after a student making $77,643 said she was running out of money and still had more booths to visit.

Kaylie Cook, whose scenario sheet said she was making $65,944 a year as a single nurse practitioner with no children, said she didn’t know how some students with lower salaries were going to make it.

“I make a good amount of money but I feel like I’m going to run out by the end of this,” she said.

Stretching dollars

Cook said one thing she had learned from the exercise is that when she is an adult, she’ll need to budget carefully so she doesn’t run out of money before she is finished paying all her bills for the month.

Giselle Gutierrez and Jose Cortez, who were waiting together in line for the housing booth, were making much less than Cook — about $34,000 and $32,000 respectively. When asked what had been the biggest surprise so far, Gutierrez said it was the cost of health insurance.

“I got lucky with insurance, because mine is company sponsored, so it’s cheaper,” Cortez chimed in.

Gutierrez said the exercise was making her feel bad for her parents, and all the budgeting choices they have to make.

“My husband doesn’t even work,” she exclaimed, looking at her scenario sheet. “What is he doing?”

Liz Marvin, a counselor at Hermiston High School, said she was glad the high school was able to bring back FAB Life for a second year, despite the pandemic. In 15 years of providing educational opportunities for students at the school, she said, “this is the highest student engagement of anything we’ve done.”

The kit with scenario sheets for students and price sheets for the volunteers was provided by ECMC Group, a student loan guaranty agency that also teaches financial literacy. It also came with other simulation pieces, such as “crystal ball” cards that teachers walk around and hand students.

“Those are the random things in life — Grandma sent $50 for your birthday, your car broke down,” Marvin said.

She said many students expressed that they hadn’t realized how many expenses they would have each month once they moved out on their own. The goal of the exercise was for students to create a balanced budget on their own, but if they needed help, they could turn to an “SOS” advisor to take a look and walk them through some suggestions of where they might cut some expenses.

“In the first group there was a couple whose sheets said they were both single, and they said, ‘Can we get married?’ and I said sure, and they split their expenses,” Marvin said.

She said the high school couldn’t have done the FAB Life exercise this year without the support from the Hermiston Chamber of Commerce and the Hermiston Walmart Distribution Center, which provided most of the volunteers for the booths and prizes — including two television sets — for students to enter a drawing after completing their scenario.