COVID-19 shutdown fuels U.S. pulse demand

Published 3:30 pm Tuesday, June 2, 2020

The COVID-19 pandemic has boosted worldwide demand for pulse crops, an industry leader says.

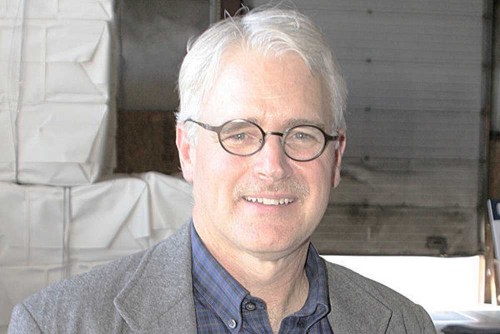

Consumption was already on the rise, but this pushed it even higher, said Tim McGreevy, CEO of the USA Dry Pea and Lentil Council.

Trending

“Some of my processors and pulse merchants have told me this is like getting two soup seasons or two dry-packaged pea, lentil and chickpea seasons in one,” he said. “It’s been that dramatic.”

McGreevy estimates consumption is up at least 50% compared to last year.

“We do have a lot of stocks on hand — in fact, they were pretty burdensome,” McGreevy said.

The council originally anticipated more than 30% of production was likely to not be sold by the end of the marketing year. Now, the holdover may be less than 10%, he said.

Exports to Europe mirrored North American demand as consumers stocked up. More pulses are also being shipped to Mexico, Latin America, the Philippines, Indonesia and Vietnam.

“We are definitely burning through some of these stock levels, for sure,” he said.

Trending

McGreevy said he hasn’t seen a similar increase consumption in his 26 years of marketing pulses.

“In times of great crisis … people have certainly returned to shelf-stable, nutrient-dense foods,” he said.

Demand has increased for both canned and dry-packed pulses. Food banks have ordered more as their supplies ran out and USDA made “fairly significant” orders of split, yellow and green peas and lentils, and canned chickpeas.

The U.S. Agency for International Development recently ordered lentils for the Africa to help replenish stores.

Tariffs in India and China continue to put U.S. pulses at a competitive disadvantage. India has a 50% tariff on dry peas, 55% on lentils and 77% on chickpeas.

“There’s not a lot of product moving into that market with those kinds of tariffs on them, although there is some,” McGreevy said. “But it’s pretty limited, in small quantities.”

Sales to China haven’t yet materialized since the signing of the Phase 1 agreement, possibly because China also got hit by the COVID-19 pandemic, McGreevy said. He remains hopeful China will buy more products.

Prices have firmed from their “freefall” last fall, increasing 15% to 20% from December, he said. Growers would like them a little bit higher, McGreevy said, “but we certainly experienced the bottom, let’s put it that way.”

Current prices are still below the cost of production, he said. Pulse acreage is likely to be down 15% across the region and the nation, he said.

Processing plants have been operating around the clock to meet demand.

The pandemic has also created some logistical problems, with limited truck and container availability.

Before the pandemic, roughly 48% of Americans cooked at home. Since the pandemic, it’s now more than 60%, McGreevy said.

“Cooking at home is good for the pulse industry,” he said.

The increased sales will likely eventually settle to more restrained levels, he predicted.

“This is a little unusual,” McGreevy said. “Not too many pandemics in our history, so … I doubt it’s going to stay at this level, at least in this more concentrated period of time.”